It always seems there is one big topic that tends to take center stage each legislative session.

And this year, it was without a doubt the topic of taxes. Whose to cut, how much to cut, what type to cut, and the cost of those cuts.

In this, there was a great deal of disagreement. Not so much between Republicans and Democrats as one might expect - but between the House and the Senate and the House and the Governor’s office.

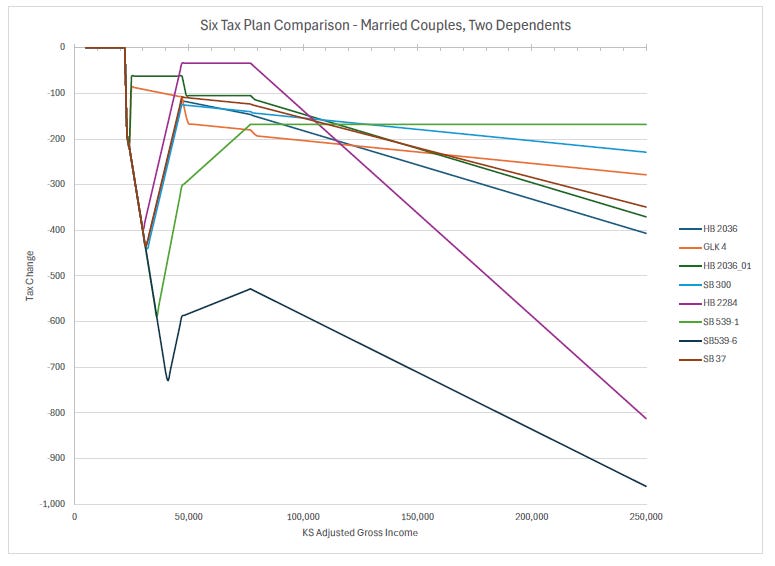

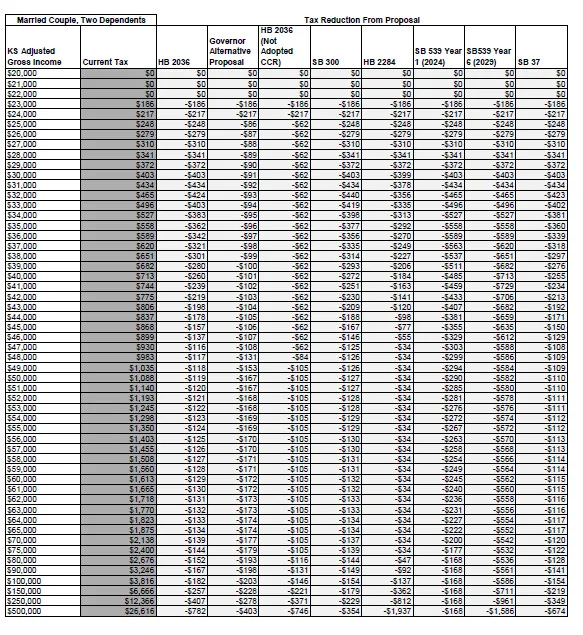

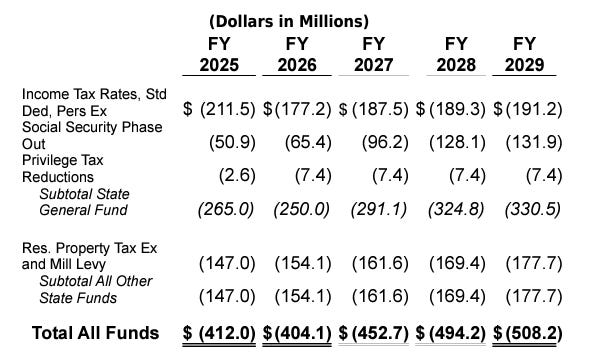

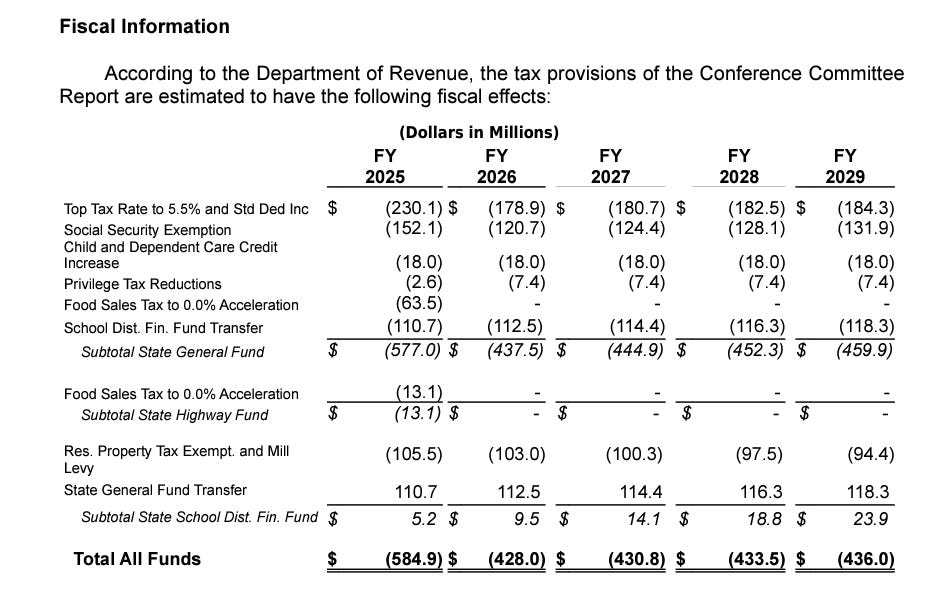

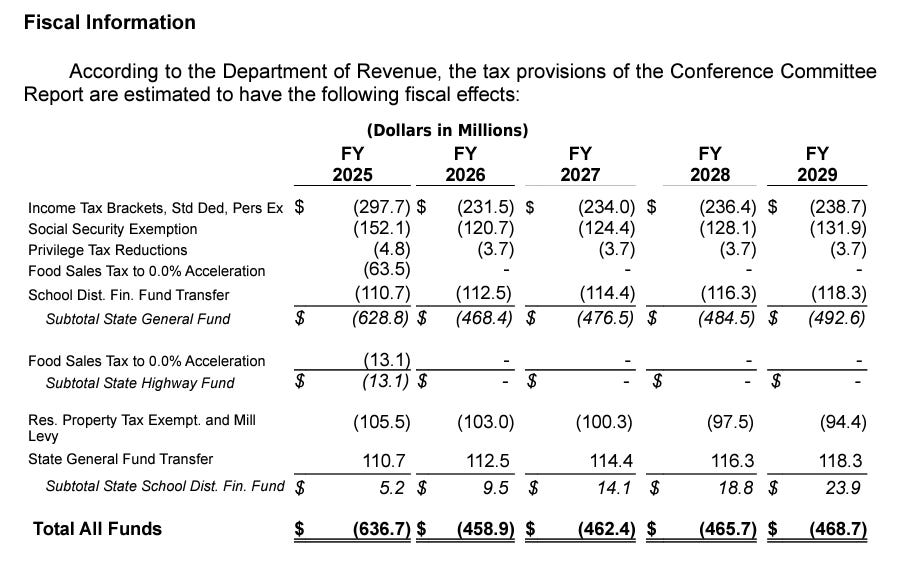

It gets a little confusing, but there have been a number of seriously considered tax plans and a few that never caught much interest or attention. All of them contained some combination of cuts to income tax, property tax, sales tax, and ending income tax on social security. The key differences were in the area of income taxes - and who would get how much savings.

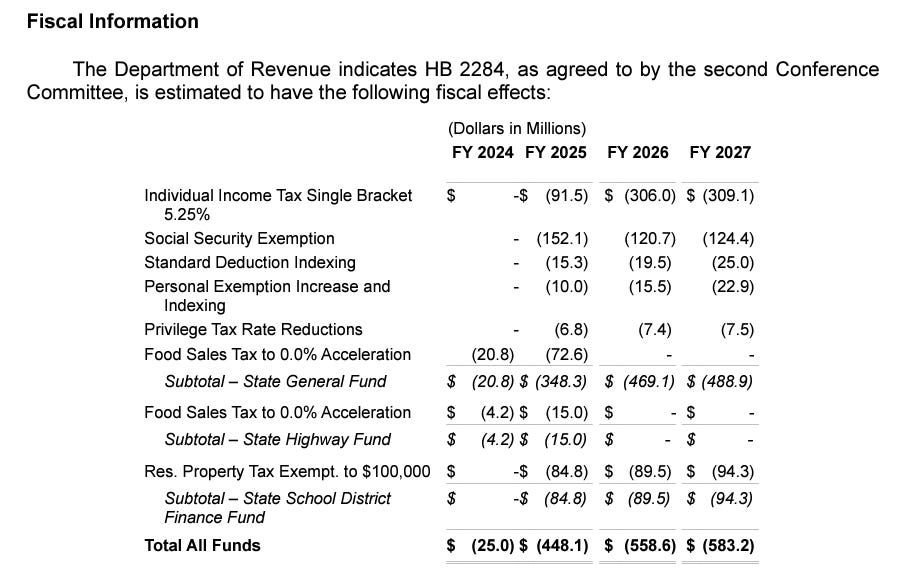

The first version was a flat tax, HB2284. Despite its misleading name and all the marketing around it, this bill did more to flatten taxes for the wealthy than any other group. That passed, and was vetoed by Governor Laura Kelly. An override attempt failed.

The Senate then passed a tax bill - SB539 - a bill so bad the House didn’t even take it up for consideration.

The House then passed out SB 300 unanimously. This was historic. You often don’t get every Republican and every Democrat voting together on something as big and inherently controversial as tax policy. But we did. Twice, in the House.

Senate President Ty Masterson declared the bill materially altered that same day and shuttled it off to die in some far-away committee.

The Senate then sent the House HB 2036. The Governor supported this bill, but the House did not like this version, mostly because in it removed any real tax savings for low and middle income taxpayers.

We sent the bill back to committee and produced a new version of the bill that was again universally supported by the House. The Governor likewise vetoed it, and an override attempt failed in the Senate.

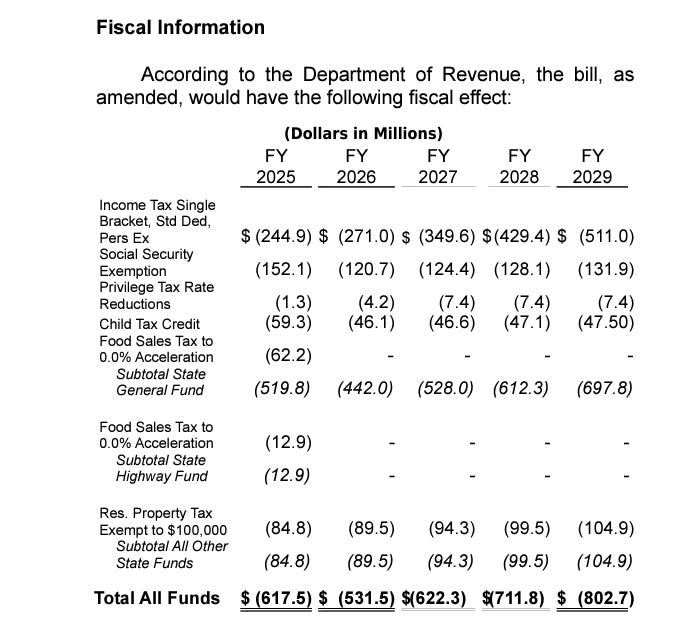

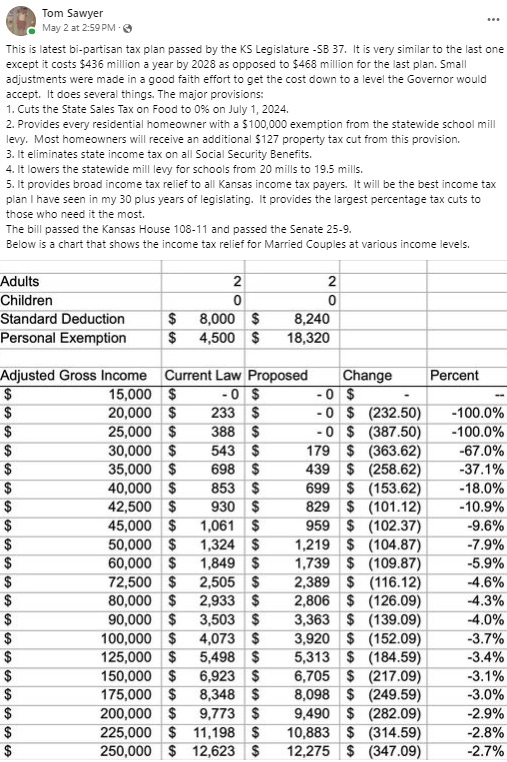

So we went back to work on another version of a tax plan, SB37. It was very similar to HB2036, but with some adjustments made to address concerns raised by the Governor.

Below is a what Rep. Tom Sawyer - who has forgotten more about tax policy and history than most of us will ever know - had to say about SB37 in a recent Facebook post.

In case you missed the small print…

“It will be the best income tax plan I have seen in 30 years of legislating.” - Rep. Tom Sawyer

Nevertheless, there’s ample reporting that the Governor’s veto on this bill is forthcoming. The argument is that it will cost too much in the out-years.

I don’t normally get terribly animated or excited about budgets and tax policy. I’ve always felt like the sort of weirdo who doesn’t really care all that much about money in a world full of people who seem to care a whole awful lot about money.

But I do care that our taxpayer money is being spent well - and on things that will benefit Kansans. I also care about solid tax policy that is fair to taxpayers, balanced across revenue streams, covers the cost of our shared values (such as education and transportation), and is stable and predictable for taxpayers.

The budget report for this year’s budget shows us with healthy ending balances for the next several years - AND shows us adding millions of dollars to the “rainy day” fund, which is projected to have a $1.8 billion balance. (All this despite the overwhelming smell of pork that’s been added to this year’s budget, courtesy of a the lobbying class and a handful of well positioned lawmakers)

I’m not going to get into slinging around angry barbs or snarky Tweets or whatever the X version of Tweets might be. Xeets, maybe? And I’m not going to speculate about what’s driving this impasse between the Governor and the Legislature. On the face, it seems we’re arguing about what we can afford to cut. The Governor says it’s all been too expensive; the House tax committee says we’ve come within $3 million of her desired level of cuts.

However, I think the evidence shows we can afford the tax cuts contained in SB37.

I’ll add that there’s always pressure to cut taxes. Most of it comes from the business lobby, armed with expensive suits, country club memberships, exotic cars, expensive wine, etc., etc., who complain that their lot, and their clients, need a corporate tax cut, another tax credit, or some other inventive welfare program for the state’s rich and famous.

OK. I did get a bit snarky, there.

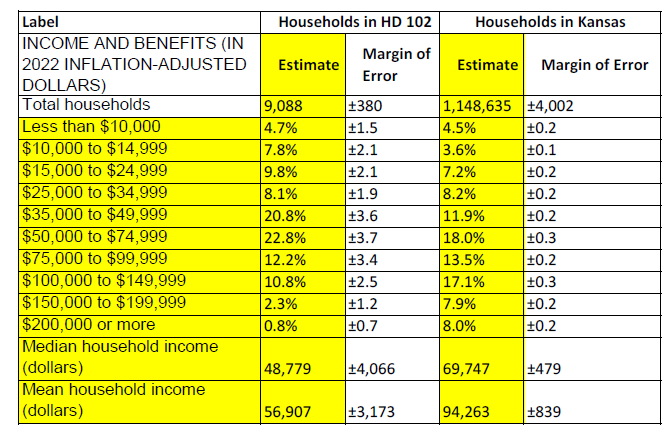

But those aren’t the people I represent. Nearly 75 percent of the households in my district make less than $75,000 and more than 50 percent make less than $50,000 a year. Statewide, 35 percent of households make less that’s $50,000/year and 53 percent make less than $75,000.

In my experience, we don’t get many chances to give real money to real people before the big money players come to get theirs. I have a real worry that if we miss this moment, most of the tax cuts will go - once again - to people who don’t need it. And that group doesn’t particularly care about the budget. After all, the legislature can just raise taxes on all of you again. Don’t ever forget that you’re still paying the sales tax that was raised in 2013 and 2015 to cover the cost of income tax cuts for corporations.

I will also say that in my view SB 300 was the best tax plan produced this year. And that every version since has been worse for my taxpayers. I don’t see that suddenly changing course if the Governor decides to call us in for a special session to address tax policy. I would expect things to get much worse and closer to the flat taxes we foiled earlier this year.

And, I would guess, leadership will get really excited about the opportunity to dig out some of those ideas that didn’t have time or traction to become reality during the regular session.

I’m hopeful that we can all have a peaceful summer where ever we are, without the worry of a hot summer in Topeka.

Thanks for this rundown, Jason; as always, your explanations are detailed and helpful. One quick question--it looks like the Local Ad Valorem Tax Reduction Fund is fated to be completely abolished, rather than just unfunded and ignored, as has been the case for the past quarter-century. I've been persuaded by those city and county officials who have pushed for it's revival (here: https://mittelpolitan.substack.com/p/insight-kansas-column-for-january); did it have any champions in the legislature? Were you one? (Don't worry, I'll keep supporting you even if your answer is no.)