I had planned to write about political performances this week.

I just didn’t know it would end up being about a rerun of the Kansas Republican Party’s one-hit wonder - Tax Cuts for the Wealthy!

The least they could do is hand this tired old tune off to Taylor Swift to perform a refreshed cover of it. But that would be kind of fun and cool, and that’s just not the KSGOP vibe.

A few weeks ago I had to admit that disgruntled Republican Senator Mark Steffen and I agreed on something: The richest corporations in the state love getting what they want, and House and Senate Republicans love giving it to them.

He called it the dirty secret of Topeka, or something like that.

The other little secret when it comes to all this flat tax flap is this: The reason every single Kansas missed out on tax relief of any kind this year is because Republicans - particularly the self-proclaimed tax savants over the in the Senate - got too greedy for Kansans’ good.

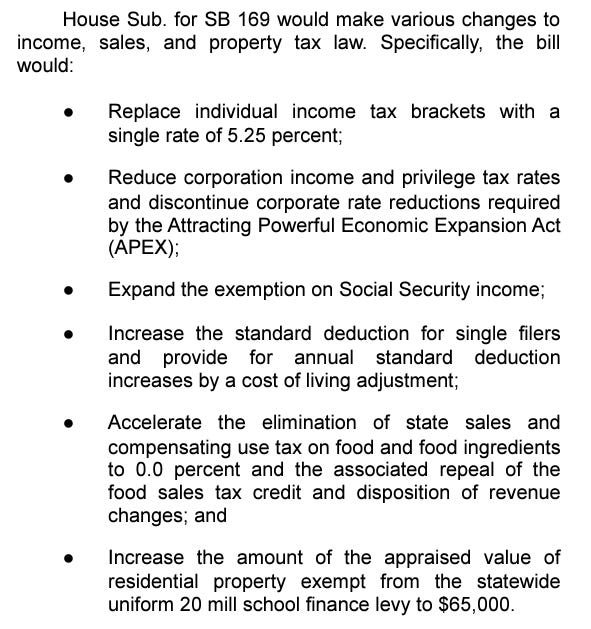

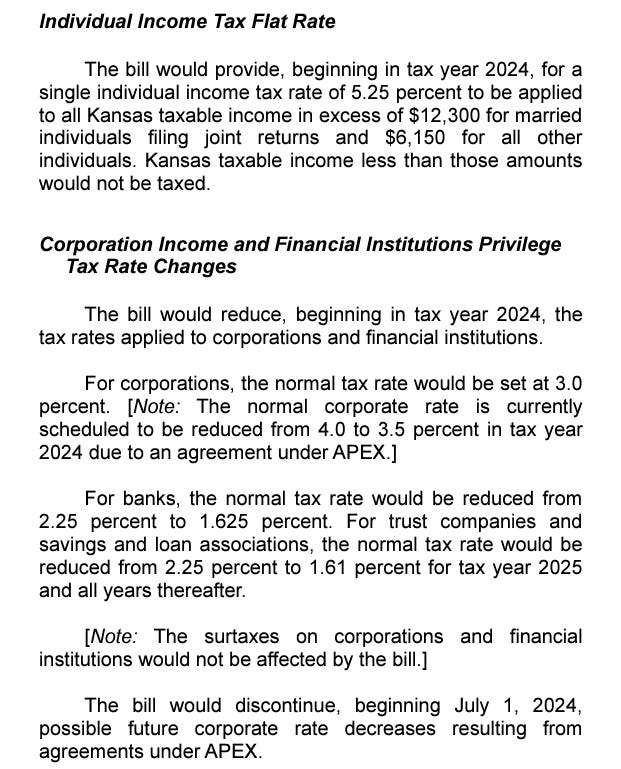

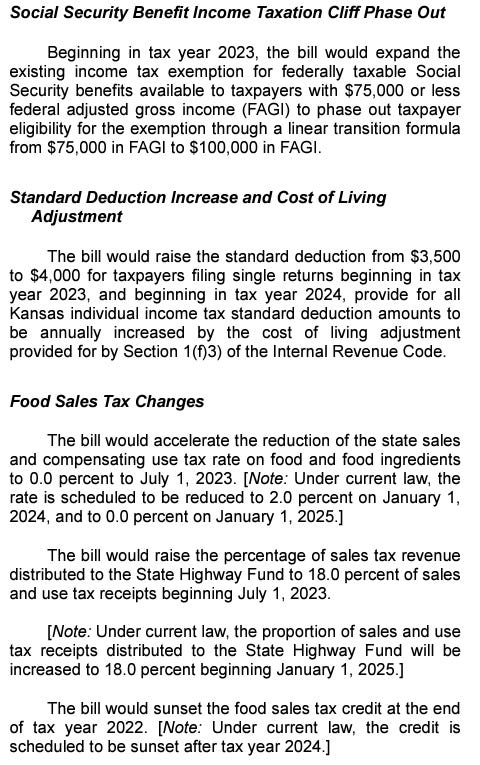

There was a flat tax bill, SB 169, that passed the House. A pretty OK one, too, as flat taxes go. It had a lot of meaningful tax reductions for Kansans. Income tax, sales tax, and property tax, a little something for everyone. It was a true example of what voters say they expect in their elected leaders - compromise to get something done that’s good for the people. It passed out on a bipartisan vote of 94-30.

I voted for it - even though I think flat taxes are bad policy. In my view, there was enough good to outweigh the bad. And unlike some of my contemporaries, I’m willing to accept that I’ll never get all the things I want. But more about that later.

I wouldn’t blame you for scrolling past this, but here are a few highlights of the tax savings you lost at the hands of Senate Republicans…

All of these things ended up in the all-knowing hands of the Senate Tax Committee - which sent back to the House a tax plan more favorable to the the wealthy, etc., etc. A number of us peeled off, but the House still voted for it and later Gov. Kelly vetoed it.

The veto override attempt in the Senate went awry - and the flat tax bill flatlined.

But that was then and this is now - 2024 is an election year. And few groups make of mess of things while pointing the finger at the other guy better than fringes of the KSGOP. They have, after all, been running the show literally forever in Kansas - all the while screaming that it’s the 17 liberals in the state you should be mad at.

I do wonder when Kansas will stop buying the myth that Republicans have the market cornered on smart business? Or good tax policy? Or that they understand how to manage an economy? They’ve been in charge all but a few years of the state’s existence, and they’re still playing the victim card. During last week’s press conference, KSGOP leadership blasted the media and said their flat tax defiantly wasn’t going to be better for the wealthy. Any other narrative is just the meanies who write words spinning you a yard.

Just like they did the last time this sort of thing came up.

“These comments about somehow it benefits the wealthy, you have to get yourself in quite a good mental contortion to get there,” Senate President Ty Masterson said. “It was a benefit for everybody just on that face value alone…You don’t always get accurate information coming through the general flows of information, through this standard sources of media.”

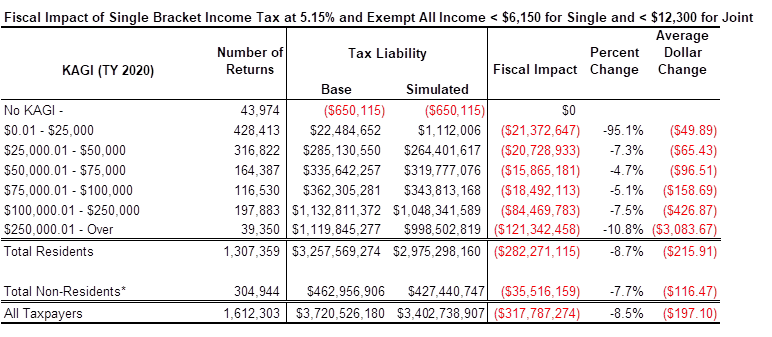

Well, here’s the document all of us were working from last session when the Senate sent its mentally contorted good-for-everyone-and-definitely-not-better-for-the-wealthy tax plan back to the House.

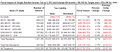

If you look at the column furthest to the right, you’ll see that a household making more than $250,000 a year will save a little over $3,000 on income taxes. The next highest savings goes to those making over $100,000 year - at a whopping $426 a year.

So our Republican friends would have us believe that people making a quarter million dollars a year will do what with their $3,000 in tax reduction? Stain their 5,000 square foot deck? Put in a new patio for the pool house? Or maybe a separate garage for the Ferrari?

Oh, wait. I forgot. They’re going to start new businesses and create new jobs and help us all realize the life we could be living. I’d say there’s a better chance that money will end up on some online gambling outfit that’s allowing bets on the future of the love life of Travis Kelce and Taylor Swift.

Though we might want to imagine that the wealthy are anointed by God to use their wealth to serve as our economic and humanitarian saviors, historical evidence tells us otherwise. Most of the time, such savings is removed from the economy altogether, or used on some out-of-state vacation.

On the other hand, had we given that sort of tax savings to the bottom four income brackets, the historical evidence shows us that the money finds its way directly into the economy - and is used in ways that improve the quality of life for families and children. Maybe better food or health care, or secure housing and transportation - but it remains in the local economy and is used to improve the lives of children and families.

Flat taxes on their faces are designed to lower taxes for the wealthy. Even if they happen to lower taxes for everyone, the bulk of the savings will start at the top. The marketing, however, speaks to our sense of fairness. If it’s true fairness we’re after, it’s better to invest in systems that allow more people to achieve stability and prosperity. That’s something we used to understand and believe in Kansas.

The problem with our vision

We have a serious perspective problem in this state. In essence, we have convinced ourselves that all good in the world flows down from the top. That anytime we enact policy that makes life more comfortable for the wealthiest among us, they will use that freedom and leisure to produce more good in the world.

It is the water we swim in. We’ve been told it our entire lives. We have crafted a life around that belief system, and even when our experience and the evidence show us this belief is a lie, many of us can’t bring ourselves to accept anything different.

And I’m not here to say that some of the wealthy don’t use their means to produce good in the world. I’ve witnessed this firsthand. Nor could I argue that a system that encourages productivity and additional income is inherently bad. It too can produce good outcomes.

But a system that puts money, profit, and wealth at the center - as a sort of economic deity - is corrupted, and destructive. A healthy and modern view on economic policy would focus less on unending profit and more on centering our humanity - both by maximizing our human capital and reducing our human suffering. (Actually, this isn’t a modern concept at all - 1 Timothy 6:10 - For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows)

It’s true that we can’t solve all of the world’s problems and we can’t solve them for every person. But that does not relieve us of our duty to do all we can to create more opportunities for more people to thrive.

And frankly, at this point, I’m jaded enough by what I’ve seen to be inclined to throw in the towel. I’ve read enough history and consumed enough anguished art to know that the wealthy never willingly loosen their grip on our systems, and they always bend it their advantage - and then use that advantage to bend those systems even more.

Fine. Take all you can. This isn’t anything we aren’t used to.

But stop telling the rest of us we don’t deserve policy that gives us a fair shot at ours.

And definitely stop telling us what we can prove is clearly only good for you is somehow good for us, too.

Keep up the good fight, Jason. Though the job seems thankless, there are those of us out here who are so very appreciative of your efforts and the wisdom you add to the legislature. Thanks! Diana