What you gonna do with all that (tax) money?

And why do we keep buying the narrative that rich folks are suffering oh so much?

Well, well, well. Here we are at the end of week number two in the Kansas legislature and what have we done? Passed another one of those flat-tax bills that’s supposed to save all of us a bunch of money.

But flat-tax is so yesterday it’s now being out the single rate tax plan - because what we’re going for here is simple. And fair. Because if there’s one thing I’ve learned in my time in Topeka it’s that people with enough money to control policy are primarily concerned with fairness for you. Because no one cares quite like a billionaire.

Without getting too into the weeds, here’s what House and Senate leadership is trying to cram down Kansans’ throats while saying it’s so very good for all of us….

Replace individual income tax brackets with a single rate of 5.25 percent;

Exempt Social Security income from the individual income tax;

Provide for annual standard deduction increases by a cost-of-living adjustment;

Provide for an increase to the personal exemption amount and future personal exemption amount increases by a cost-of-living adjustment;

Reduce privilege tax rates (paid mostly by banks)

Accelerate the elimination of state sales on food

Increase the amount of the appraised value of residential property exempt from the statewide uniform 20 mill school finance levy to $100,000.

Some of these things aren’t bad - I’ve always thought we needed to increase the standard deduction for inflation and exempt more from property taxes. And a whole bunch of us wanted to get rid of the sales tax on food in full more than two years ago, but the people who run this building decided then that wasn’t a good idea.

Make no mistake that anything that’s good in this effort is just sugar designed to make the disgusting parts taste better. Because what this whole thing is really about is saving the state’s wealthiest taxpayers money.

According to numbers from the Kansas Department of Revenue there are 1,280,574 income tax returns by Kansas residents. Of those, 48,881 report earning over $250,000 a year - less than 4 percent of all tax filers in the state. Yet that group stands to get 52 percent of the entire savings from this more fair income tax structure.

Meanwhile, nearly 37 percent (471,726) of the state’s middle income tax filers between $25,000 and $75,000 will reap just 9 percent of the total tax savings.

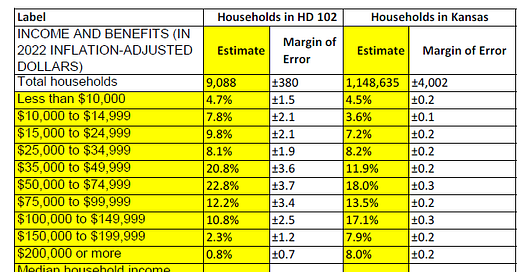

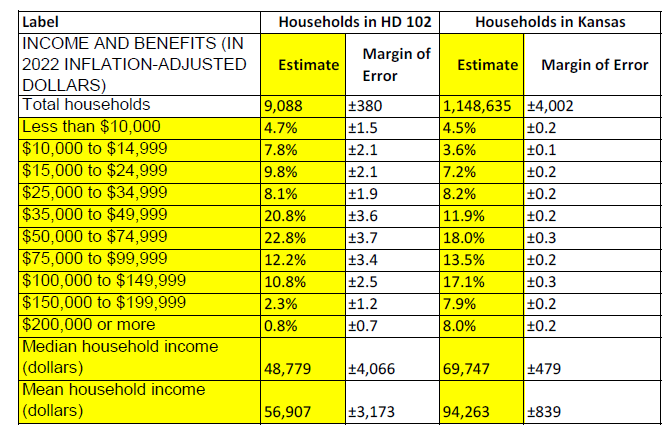

Here’s the picture in the 102nd House District, where I live…

That’s right - .8 percent of of my taxpayers would see real benefit under this plan. The nearly 52 percent of taxpayers who make less than $75,000 per household wouldn’t get any real benefit at all.

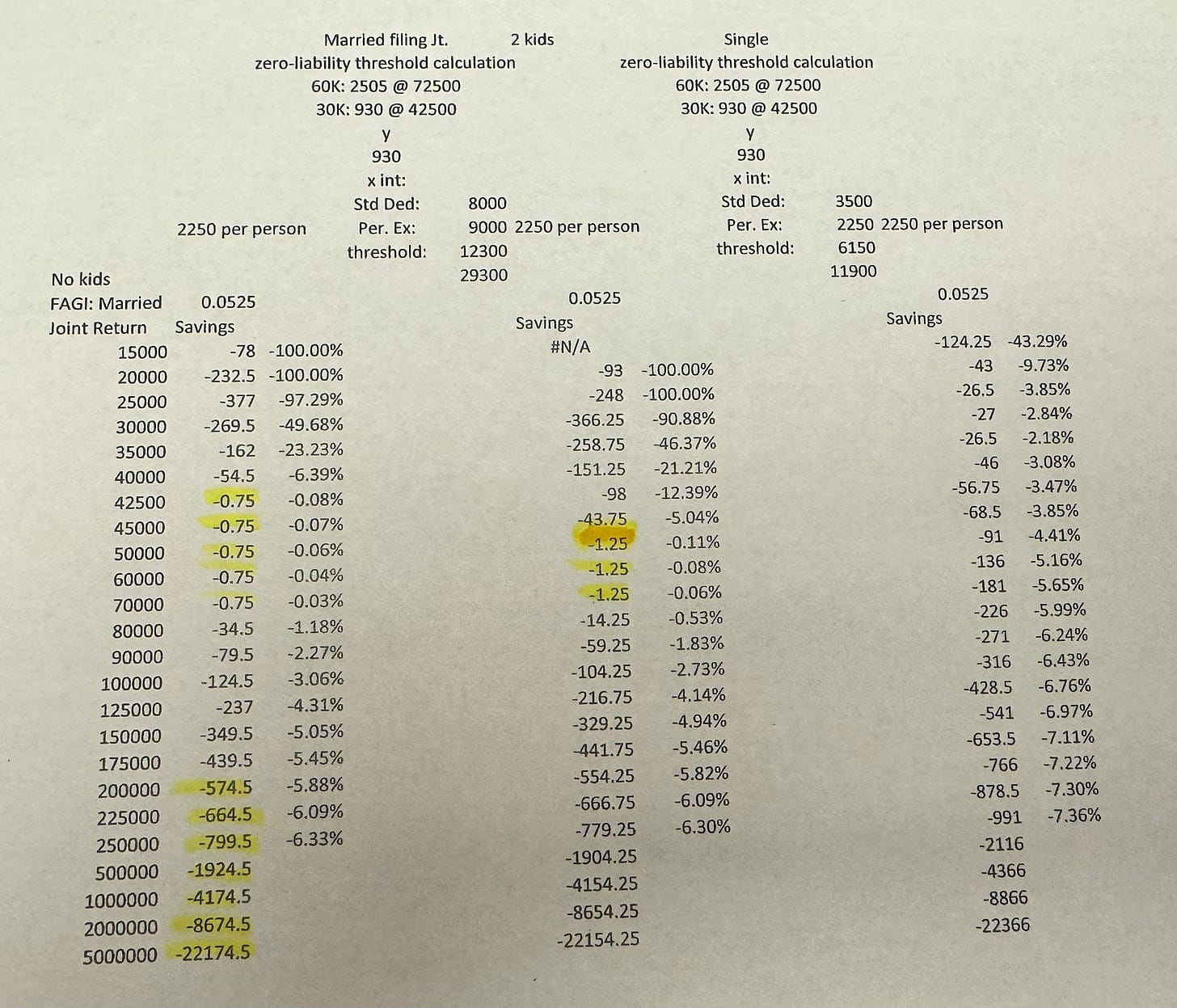

Rep. Tom Sawyer, who has been working on tax policy for generations, ran a spreadsheet breaking the brackets down even further. For those working families firmly in the middle - making between $40,000 and $75,000 a year - they’ll realize an average savings of …..wait for it… $.75 for a married couple without kids, or $1.25 for a couple with two kids. (Take note of the savings for the big earners at the bottom)

The bottom line is this tax plan isn’t going to save you any real money. And if we were serious in this building about saving working people money, we’d be talking far more about raising the standard deduction, significantly raising the personal exemption, not even taxing income under $50,000 a year - and we’d certainly be talking more about finding a way to offset property taxes.

But enough with the numbers.

To better illustrate how absurd this plan is, I am sharing a selection of items you CAN’T afford to buy with the income tax savings Kansas’ richest folks have deemed is fair for you - but mostly for them.

This was on sale though, so families with kids could afford one box of Mac & Cheese with their gigantic and super fair tax savings. Happy spending!

Seem like the next shoe to fall is what programs will not get funded at the State, County or City level to balance the budget with less income tax.